The Bank of the United States was a central bank proposed by Alexander Hamilton and established in 1791. Among other functions, the private bank issued paper money, completed commercial transactions, and collected government tax revenues as well as lent money to the government. To be successful on Bank of the United States APUSH questions, make sure you understand why the bank was created and why it was controversial.

What is the Bank of the United States?

After the Revolutionary War, America suffered widespread economic instability. The country’s debt was steep, and many states were bankrupt. In order to stabilize the economy, Alexander Hamilton, the Secretary of the Treasury, proposed an ambitious financial plan that would establish a national bank, create a federal mint, and impose excise taxes. The bank was conceived as a way to improve and build the nation’s credit, as well as create a common currency.

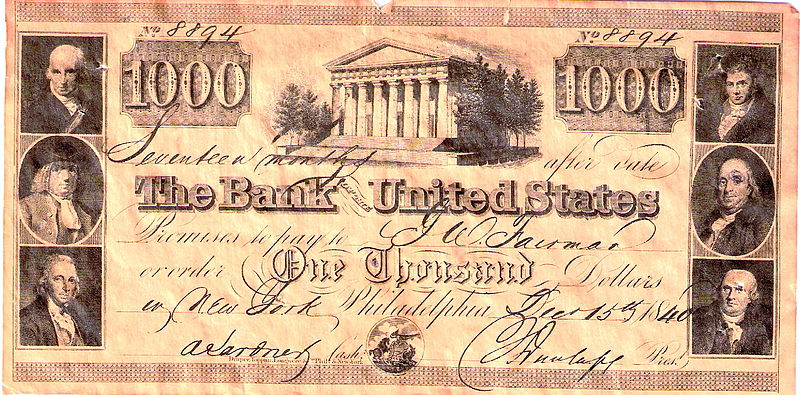

President Washington signed Hamilton’s bill into law, and what would later be known as the First Bank of the United States was opened in 1791 with a 20-year charter. At the time it was opened, the bank was the largest financial institution and corporation in America. It opened branches in major port cities, establishing a vast financial network across the country. The bank was successful as both a commercial bank and as the government’s fiscal agent. Its banknotes were widely accepted and gave the country a stable national currency. Although not intended to regulate the banking system, by accumulating state banknotes it could control the flow of money and credit, thus helping control inflation.

Despite its success, the First Bank of the United States faced much criticism, and in 1811 its charter was allowed to expire. In 1816 the Second Bank of the United States was created in the wake of the financial difficulties brought on by the War of 1812.

Important years to note for the Bank of the United States:

- 1791: The bill establishing the Bank of the United States was signed, and the First Bank of the United States was opened.

- 1811: The twenty-year charter of the bank expires.

- 1816: The Second Bank of the United States is opened.

- 1836: The Second Bank’s charter is allowed to expire under President Andrew Jackson, an outspoken opponent of the institution.

Why is the Bank of the United States so important?

The First Bank of the United States was the first central bank to serve as the American government’s fiscal agent. It was also a stable national bank open to public and commercial transactions, at a time when the nation only had local banks with limited scope. The paper currency issued by the banks helped establish a uniform national currency, stabilizing the young country’s fragile economy after the devastating war.

The bank was also controversial, opening up the divide between the Federalists and the Democratic-Republicans (led by Thomas Jefferson), as well as the divide between the northern mercantile economy and the southern agricultural economy. Jefferson claimed that it was unconstitutional for the government to establish a corporation, and he feared that the bank would benefit the elite interests of Northern business over the common interests of the public, especially those in the South, who likely would not see the commercial benefits of such a bank. This strong opposition to the bank persisted even after its success and was the reason its charter was not renewed.

Who are some historical people related to the Bank of the United States?

- Alexander Hamilton: First Secretary of the Treasury who proposed the bank.

- Thomas Jefferson: Led the opposition to the bank.

What is an example Bank of the United States APUSH question?

“Hamilton’s financial system had then passed. It had two objects; 1st, as a puzzle, to exclude popular understanding and inquiry; 2nd, as a machine for the corruption of the legislature; for he avowed the opinion, that man could be governed by one of two motives only, force or interest; force, he observed, in this country was out of the question, and the interests, therefore, of the members must be laid hold of, to keep the legislative in unison with the executive. And with grief and shame it must be acknowledged that his machine was not without effect; that even in this, the birth of our government, some members were found sordid enough to bend their duty to their interests, and to look after personal rather than public good.”

-Thomas Jefferson, 1818 (Source)

What was Jefferson’s primary criticism of the Bank of the United States?

A) The paper currency it issued was largely inaccessible to citizens in the agrarian south.

B) The bank’s foreign shareholders were allowed to vote on elections and corporate issues.

C) The incorporation of a financial institution by the federal government was unconstitutional.

D) The bank’s accumulation of state notes would stifle lending and cause financial collapse.

Answer:

The correct answer to this Bank of the United States APUSH question is (C). Jefferson believed that it was unconstitutional for the federal government to establish a corporation. Such a move, he argued, created a vast conflict of interest that benefited an elite ruling class of politicians and bankers. He also believed that a central bank took power away from local financial institutions and would cause an imbalance in the country’s monetary system.