Joint stock companies were economic partnerships that proved crucial to English settlement of the New World. Joint stock company APUSH questions will center on the impact that these ventures had on colonial settlement.

What is a joint stock company?

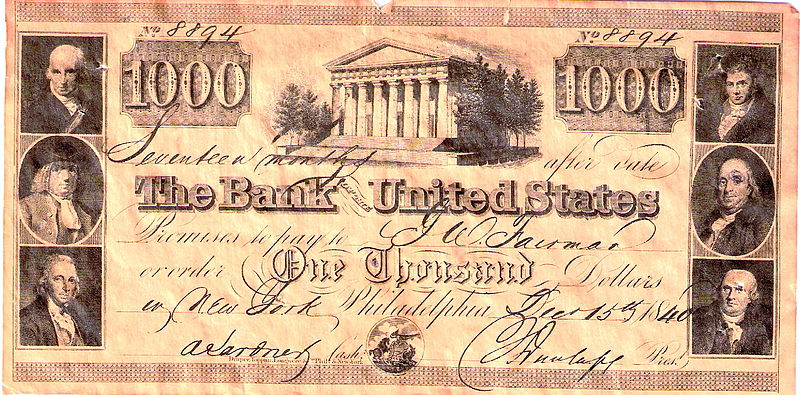

A joint stock company is a company made up of a group of shareholders. Each shareholder invests some money in the company and, in turn, receives a share of the company’s profits. Joint stock companies had been used successfully in various trading ventures in the past. In the early 1600s, however, a risky new form of joint stock venture arose and became extremely important— the joint stock company for colonization of the New World.

By the turn of the 17th century, England had fallen behind in the European scramble for exploration and colonization of the Americas. Spain and Portugal dominated the New World. The English crown, with little revenue to spare, was reluctant to invest treasury money heavily in a venture as risky as overseas exploration. The monarchs were more than happy to let private investors make such a risk, however. The crown chartered joint stock companies, where investors could sponsor colonization and other overseas ventures.

Important years to note for joint stock companies:

- 1606: King James I authorizes the charter for the Virginia Company, the joint stock company that would send settlers to Jamestown, England’s first permanent settlement in the New World

- 1607: Founding of Jamestown

Why were joint stock companies so important?

Joint stock companies allowed England to become a major player in colonization of the New World. Without joint stock companies, the British may not have been able (or willing) to afford to create the thirteen colonies.

Joint stock companies were also used for trade. For instance, the British East India Company, which caused problems for colonial-British relations in the lead-up to the American Revolution, was a joint stock company. By the 1760s, the BEIC was floundering and the British government used the much-loathed Tea Act to give the company a monopoly on tea in an attempt to bail it out.

What are some historical people related to joint stock companies?

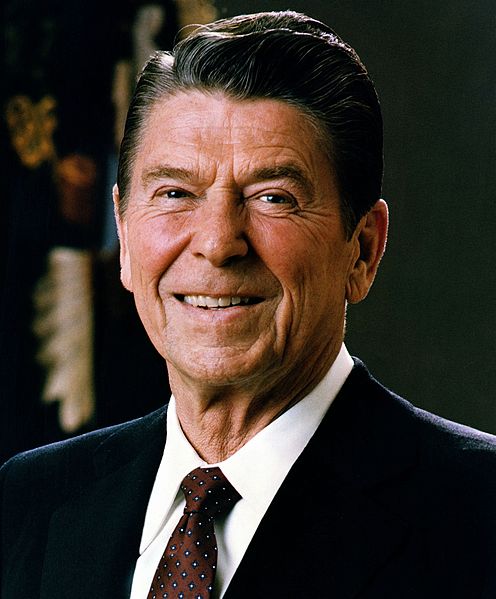

James I: British monarch who granted a charter to the Virginia Company to start a colony

What example question about joint stock companies might come up on the APUSH exam?

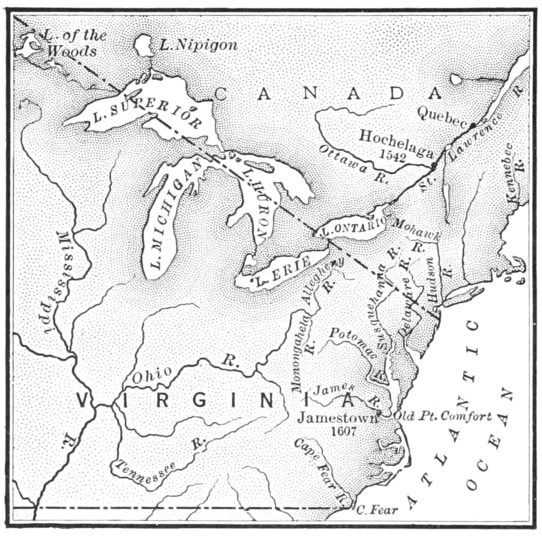

Land granted to the Virginia Company by charter in 1609 (Source)

Joint stock companies such as the Virginia Company played an important role in the colonization of North America because they

A) allowed colonists a greater degree of self-rule than other groups that formed settlements.

B) created the first settlements by any European power in the New World.

C) created settlement ventures that were entirely funded by the British government.

D) used private sponsors to fund authorized settlement on behalf of the crown.

Answer:

The correct answer is (D). Joint stock companies such as the Virginia Company were granted charters by the British government, but they were funded by private investors. This provided a way for the British to get involved in the colonization of the New World while minimizing economic risk to the crown.

Leave a Reply